PERSONAL INJURY INSURANCE

What Does Your Personal Injury Insurance Cover?

So many of us live in a fools’ paradise, we think that accidents and the death of a spouse/partner, only happen to other people. We hear of accidents every day on the radio programs and news items, but they don’t touch you unless you know the people involved.

What if it happens to you?

Would you know what to do?

Who to contact?

What your Personal Injury Insurance Covers?

Perhaps, you are like many of us who have been protected by our husbands/partners taking care of all the “business affairs” of the family and now are on their own.

Now it Is The Time To Wake Up To What Are Now Your Responsibilities – do you have PERSONAL INJURY INSURANCE?

Vehicle accidents happen every day and you should be ready should you be the next victim. Now would be the time to contact a good Law Firm, such as Kinney, Fernandez & Boire, arrange a meeting with one of their Attorneys, and seek advice as to what you would be covered for, should you be involved in an accident.

This cannot be left until after the fact.

You will need to know how well you are covered in case of so many things that could be the result of the accident.

Would your Personal Injury Insurance cover the following:-

- What happens if you are seriously injured and need long term hospitalization?

- On-going treatment?

- Physiotherapy?

- Occupational Therapy?

- Job Loss? Due to time off work. Psychological Help due to the stress caused by the accident and how it has affected your life.

- Perhaps you have lost a limb or mobility.

There will be so many questions you will need to be answered. It might even be a good idea to write the questions regarding your Personal Injury Insurance down before you to your appointment. It is so easy to walk out and think, I should have asked this or that, as it is not something one does every day.

The good thing is that you now have consulted a reliable Attorney, such as Kinney, Fernandez & Boire and are now aware of your legal rights as far as your Personal Injury Insurance goes, and you will be able to call him/her and ask the questions you still need to be answered.

This will put your mind at ease on that score.

After the death of your Spouse/Partner, here are just a few of the things YOU will now need to attend to:

The shock of losing one’s loved one can throw you off kilter and it is not wise to make big decisions like selling your home and moving etc., for at least six months or so.

Sadly though there are things that cannot wait.

- Payments to be made and these are some the new things that will now fall on your shoulders.

- Learn to use the computer, if you don’t know how, and have to do online payments. It is a good thing to go for lessons and to persevere.

- If you don’t already have a Banking Account – open one in your name.

- Have the payments for Insurance Policies, Personal Injury Insurance, Levy, Medical Aid etc. automatically taken off your account by debit order.

- Make sure that the car is registered in your name.

- Keep records when payments will be due for things like the Vehicle License, Post Office Box, Television License. All the annual payments.

- If you are a Pensioner, consult with the person who is looking after your affairs and make sure you are fully versed in what is happening with the Investments. It is useless to keep your head in the sand and ignore the very things that will matter for your future financial welfare.

Once all the shock has worn off and the financial matters in hand, it is now time to think of taking your own life back.

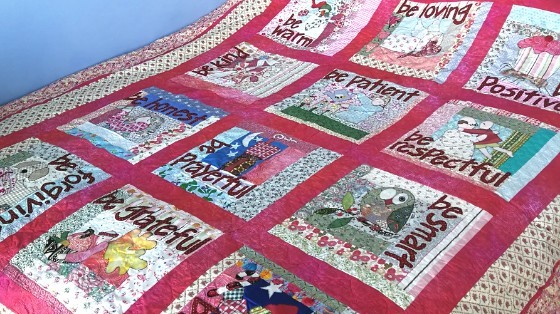

Take up a new hobby. Think of something you have always wanted to try, like quilting, machine embroidery, if you are a keen sewer. Or carpentry.

Something that will take your mind off the bad times: There are so many choices to make and exciting things to do.

Traveling Alone can be a daunting prospect – make sure you have a Personal Injury Insurance Policy in case of any mishap

Perhaps you will find the confidence to go on a road trip and stop at all the places that catch your eye.

Or even go further afield and go on a fabulous cruise. I can recommend going on a Carribean Cruise as I have been on one, many years ago, mind. It was the most amazing experience and I can vouch for the wonderful treatment one get with Royal Carribean Cruise Lines.

I am sure that if your jaw got tired while eating the fantastic food, the ever attentive waiters, would even chew for you.

Joking aside, don’t be afraid to take a trip on your own. There will be many more doing exactly the same and you could make some wonderful new friends.

There are so many things you can do if you step out with courage, don’t let fear hold you back.

Hi Jill

Thank you for raising an awareness to something that most people don’t think about.

I like the fact of making sure to understand what the insurance covers.

Most of us are in a lull because we don’t realize it could happen to us. Life can change from ane minute to the other without warning and it’s hard to cope and let alone having to cope with all that sadness and no insurance.

I lost a brother to a car accident and it’s been years but I still see the sadness on my brother’s children’s faces. It’s unbearable. Lucky he was insured. The car was a write-off.

Thank you for the suggestions on how to move on. My sister-in-law still finds it really hard. Losing a loved to an accident is really not easy – too much shock to ever recover from.

Thank you Jill for all your helpful suggestions.

~Danielle

Hi Danielle, I understand about loss and how hard it is to get over losing someone dear to you. One can only be there for those feeling the hurt and understand their pain.

Thinking of you all.

Kind Regards, Jill

Hi Jill

Thank you for such an informative post.

We never realize how things can shift from one minute to the other. Before it happens to us, we are in a lull because we feel comfortable, viewing accidents as something that happens to other people.

Thank you for this article because it helps us to think things through and be prepared. I lost a brother to a car accident and I know the pain of losing a loved one. I watch my brothers 3 children and always see the sadness on their faces even though it happened years ago. The lucky bit is that he was insured.

Thank you for raising the awareness to all of us and for the suggestions on making sure to understand what the insurance covers. I think that is very important.

Thank you for the suggestion on ways to cope with the loss. It is really hard for most to move on. My sister-in-law still can’t find solace. It is really hard for her.

Thank you

~Danielle

Hi Danielle, Am so sorry to hear about your loss and also that your sister-in-law is not coping. It is very hard to go through the grief process and for each person it is different. Thank you so much for reading my post and finding it helpful.

Hi Jill,

This is such a timely post, a few weeks back my friend’s sister met with an Car accident and my friend is still going through a harrowing time with the Insurance company for the claim process.

His sister is safe but her right hand is apparently fractured. His sister had a Accident Policy but had no idea of what that policy covered. To cut the long story short, they didn’t do their necessary due diligence before buying the policy and are paying the price for it.

I hope after reading this post, people take more informed choice. Thanks for sharing.

Hi Satish,

It is so important to know what you are insured for and also that you have a current will. People don’t realize what difficulties come about when this is not done.

This post is really informative and is something we all need to stop and think about. It is easy to forget about things like insurance until it is too late and you find out that you are not covered. I will be making note of this article and will refer to it in the future.

Hi Shyla, It is never too early to get insurance and also a will drawn up, but sometimes can be too late. Things happen when you least expect them to.

I would love to be able to get insurance. But I am on the uninsurable side. Thank you for the well-written explanation of what insurance should cover. Taking up a hobby when going through a tough time is probably one of the best things to do to get through the insurmountable grief.

Hi Jagi, It was joining Wealthy Affiliate and learning something new and absorbing that helped me so much and I will be eternally grateful. I love all the hobbies I am involved in but WA has taken up a lot of my time and I am loving it.

That’s a lot to take in if that ever happened. You are right finding a good lawyer and getting your financials in order would be the best thing to do especially if you were the at-fault party in an accident. Thanks for the advice and I need to change some things for me personally just in case.

Hi Jason, Thank you so much for reading my post and the comments. It is so important to be on top of all your financial affairs and also to have a current will.